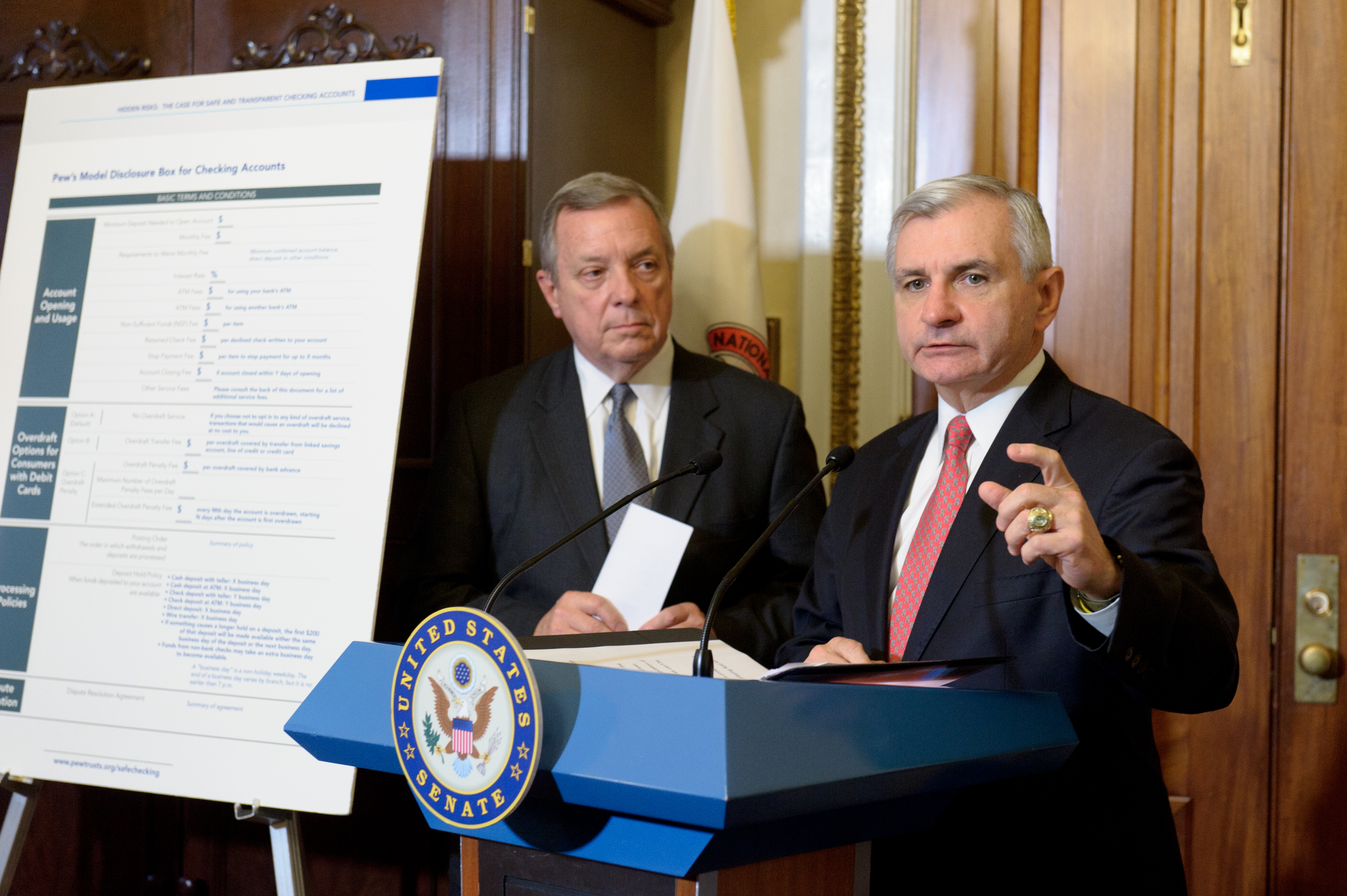

Durbin, Reed Call on Banks to Adopt Fee Disclosure Form

After Big Banks Cancel Debit Fees, Protections Needed From New Hidden Fees

WASHINGTON, DC – U.S. Senators Dick Durbin (D-IL) and Jack Reed (D-RI) today called on the nation’s financial institutions to voluntarily adopt a bank account fee disclosure form designed to make checking account terms and fees transparent and easy for consumers to understand. Following the sensible decision by Bank of America, Wells Fargo and other banking giants to roll back or cancel planned debit card usage fees, consumers are now at risk from new, hidden fees being issued in their place. The Senators were joined by Susan Weinstock, Director of The Pew Charitable Trusts’ Safe Checking in the Electronic Age Project, which has designed a clear and simple form for financial institutions to adopt. A copy of that form is attached.

“Transparency and competition are the two pillars of a strong free market economy. Those are the rules that Main Street American businesses live by, but for years, big banks have tried to play by a different set of rules,” Durbin said. “We saw this week that the consumers of America have had enough. Today we’re calling all of the nation’s financial institutions to adopt a one-page, easy-to-read model disclosure listing the fees and key terms for their checking accounts. Giving consumers information clear, upfront and accurate information about the fees that they will be charged will allow consumers to shop around and make sound financial decisions.”

"Consumers want a fair shake and better of understanding of what they’re paying and why they’re paying for it. Too often we hear about financial institutions changing the timing and amount of all kinds of different surcharges. It is time to bring these fees into the open because the best market is a transparent market, and that’s why we think up-front transparent disclosures help consumers make well-informed choices and improve the entire marketplace,” said Reed.

“One hundred and eleven pages. That is the median length of the checking account disclosures customers are supposed to read and understand before opening an account. This volume of highly technical information makes it difficult for consumers to know how their checking account operates,” said Weinstock. “Failure to provide succinct and comprehensive data can expose accountholders to hidden risks. We are calling on the Consumer Financial Protection Bureau to require banks to provide information about checking account terms, conditions and fees in a concise, easy-to-understand format. It’s what consumers want and it fosters a more competitive marketplace for all financial institutions.”

Durbin and Reed also sent a letter to Raj Date, Acting Director of the Consumer Financial Protection Bureau, asking the consumer watchdog to quickly require financial institutions to post on their websites a standardized, concise and consumer-friendly disclosure form that lists the fees and key terms associated with checking accounts.

“In recent weeks, American consumers have made clear their desire for honest information about banking fees. Simply put, consumers have had enough of banks that try to sneak fees past them that are hidden in fine print or imposed with no notice at all,” the Senators wrote. “While we recognize that the CFPB is still in its formative stages and that it has many important tasks currently underway, we urge you to prioritize this matter and to use your regulatory authority to quickly ensure transparency for checking account fees.

A copy of the letter to the CFPB is also attached.